Resource Stocks Will Change Forever:

New “Blue Water” Formula

Is Unlocking Billions of Dollars’ Worth of This Essential Battery Metal

(And Making Early Investors A Fortune)

Hello everyone, John Carl here.

And right now I’m standing in 100-degree heat in the middle of the desert.

I’ve driven for hours through the Arizona sun to visit the giant warehouse you see here...

All to hold this cup of blue water.

It may not look like much, but inside this cup of blue water is a special solution that holds an essential metal that America can’t make-do without…

- It’s in every single piece of electronic technology — in your cell phone, your TV, your computer, your coffee machine, your blender… in fact, it’s also in every single lightbulb in your house.

- The electric vehicle revolution depends on this metal — there are more than 200 pounds in the motor of every single EV, and at least 50 pounds more in the rest of the vehicle.

- And, then here’s the big one, it’s the #1 material used in America’s power grid — the millions of miles of wire that stretch from shore to shore across the country. Taken together it’s the world’s largest machine… and it’s in desperate need of a trillion-dollar upgrade by the year 2035.

But that’s not all.

The market for this metal has been growing at an enormous clip — far outpacing the available supply.

Demand has emptied the world’s stockpiles... so much so that, according to Bloomberg, they’ve fallen to a 25-year low.

“The warnings keep getting louder: the world is hurtling toward a desperate shortage of [this metal.]”

— Bloomberg

And it’s showing no signs of slowing down.

Bloomberg expects an additional 58% surge in demand by 2040.

Considering that the world already uses over 21 million tons of this metal every year, that’s an enormous amount of growth.

Just to give you a sense of what a massive amount that is, consider this...

The Empire State building weighs 365,000 tons.

So we currently consume the equivalent of 57 Empire State buildings every single year.

And we’ll need 33 Empire State buildings MORE... just to keep pace.

And get this — from everything I’m reading, these are low estimates.

A new report from the US government’s Energy Information Agency (EIA) says that the actual demand for this metal will be even HIGHER.

And according to a recent market report from Goldman Sachs, the spike in demand “has only just begun.”

Which brings us back to this cup of blue water.

It holds the future of getting more of this metal out of the ground — faster, cheaper, and with minimal environmental impact.

It’s a complete gamechanger in boosting the supply of this metal.

Which, as you may have guessed, is...

COPPER.

This infinitely useful metal has been mined by humans since the beginning of recorded history.

But it’s never been more essential than right now.

Copper is the backbone of all modern technology, and I mean ALL — every phone, every computer, every car, every home, every office.

Almost every single human on the planet uses copper every single day.

And for thousands of years miners could only get more of this metal by digging bigger and bigger holes in the ground.

As Bloomberg put it:

“Humans are more dependent than ever on a metal we’ve used for 10,000 years; new deposits are drying up, and [up to this point] the type of breakthrough technologies that transformed other commodities have failed to materialize for copper.”

— Bloomberg

Blue water is that long-awaited breakthrough.

Its powerful chemical formula can pull copper drip-by-drip out of the rock.

And this is just the beginning of what it can do.

It’s so effective at extraction that new versions of this blue water formula can now pull copper out from low-grade rock that was impossible to mine before.

As one industry head put it:

“It’s the equivalent of bringing on a new mine without having all the capital cost.”

— Freeport McMoRan President Kathleen Quirk

So I hope you’re paying attention, because it’s not often we find something like this.

Blue water is easily the most important advancement in the history of copper mining.

And as I’ll explain in detail over the next few minutes…

One small junior resource company controls the recipe for this all-new blue water formula.

Secret Chemicals Will Unlock “Impossible-to-Mine” Copper Reserves Forever

More than 80% of the world’s copper is trapped in billions upon billions of tons of low-grade waste rock.

So that means up ‘til now the overwhelming majority of the world’s copper couldn’t be reached.

It’s what miners call a “stranded resource.”

For hundreds of years it’s been piled into useless heaps, with all that copper stuck in rock that’s far too low-grade to justify sending to the smelter.

Until now.

This junior resource company's cutting-edge chemical formula can seep through the waste rock and pull out the valuable copper.

It’s a complete game changer for copper mining.

And this small mining firm controls it through an exclusive deal with Rio Tinto, one of the biggest names in the mining space.

And by big… I mean absolutely enormous.

Rio Tinto is the 116th largest company in the world. It has 45,000 employees and generates $60 billion every year.

And yet, big as they are, it’s this tiny firm that’s going to spearhead this next-generation copper leaching program.

So why does one of the largest mining companies in the world need this little junior to carry out its goals?

It’s because this company — “small” as it may seem — is on the cutting edge of this technology.

And over the next few minutes, I'm going to show you why their project has unique advantages that make it the ideal testing spot for this brand new world changing chemical extraction process.

Today you’ll hear why this junior miner is so essential to unlocking an enormous fortune.

And not only that.

This opportunity also includes several top-secret chemical solutions that Rio Tinto has been developing for over a decade — but hasn’t used commercially until this moment.

But there’s more.

Unless you know the top names in the mining industry, or have access to the world’s leading geologists, then you’d never even know this company exists — at least not yet.

An Industry-Insider Darling

The only reason I know about it is because of our resource guru Gerardo Del Real.

He’s spent more than a decade developing an extensive network of in-the-know industry insiders.

Gerardo first heard of this firm at an exclusive, invitation-only mining conference in Beaver Creek, Colorado, that’s attended by the who’s-who of the mining world.

If you weren’t there… then you’d never know about it.

Gerardo’s industry colleagues told him about these new advances in copper leaching — and just how effective these new chemical solutions were at pulling copper out of waste rock.

I was invited to join Gerardo for part of the conference and help him complete his interviews with the industry elites.

And the moment I heard the details, I knew I needed to see this for myself.

Gerardo agreed this was something worth investigating.

So I flew out to Phoenix, Arizona…

And drove an hour south into the Sonoran Desert…

Then donned a hard hat and vest.

I had to sign my life away at the security building — they even have rules that require drinking only bottled water and backing into parking spaces.

And they completely forbid photos and video.

I had to get special permission from the company’s management to record the materials you see here.

It’s a rare opportunity to peek behind the security gate…

And it’s only thanks to Gerardo that we have this level of access.

He’s been on the inside of the mining industry for more than a decade, and he’s seen outstanding returns from this hidden market.

It’s how he found out about an industry-favorite called K2 Gold Corp...

When you’re following where the industry dollars are going, as Gerardo does, you don’t usually have to wait long to make big returns.

Industry insiders have been at this for decades, they know when to make their move.

Gerardo used what he discovered from his industry network to make 592% gains in less than 7 months on a junior resource company…

These are actual returns, not some hypothetical pulled from a chart.

Gerardo was able to turn every $10,000 he invested into $69,200.

And this wasn’t a one off.

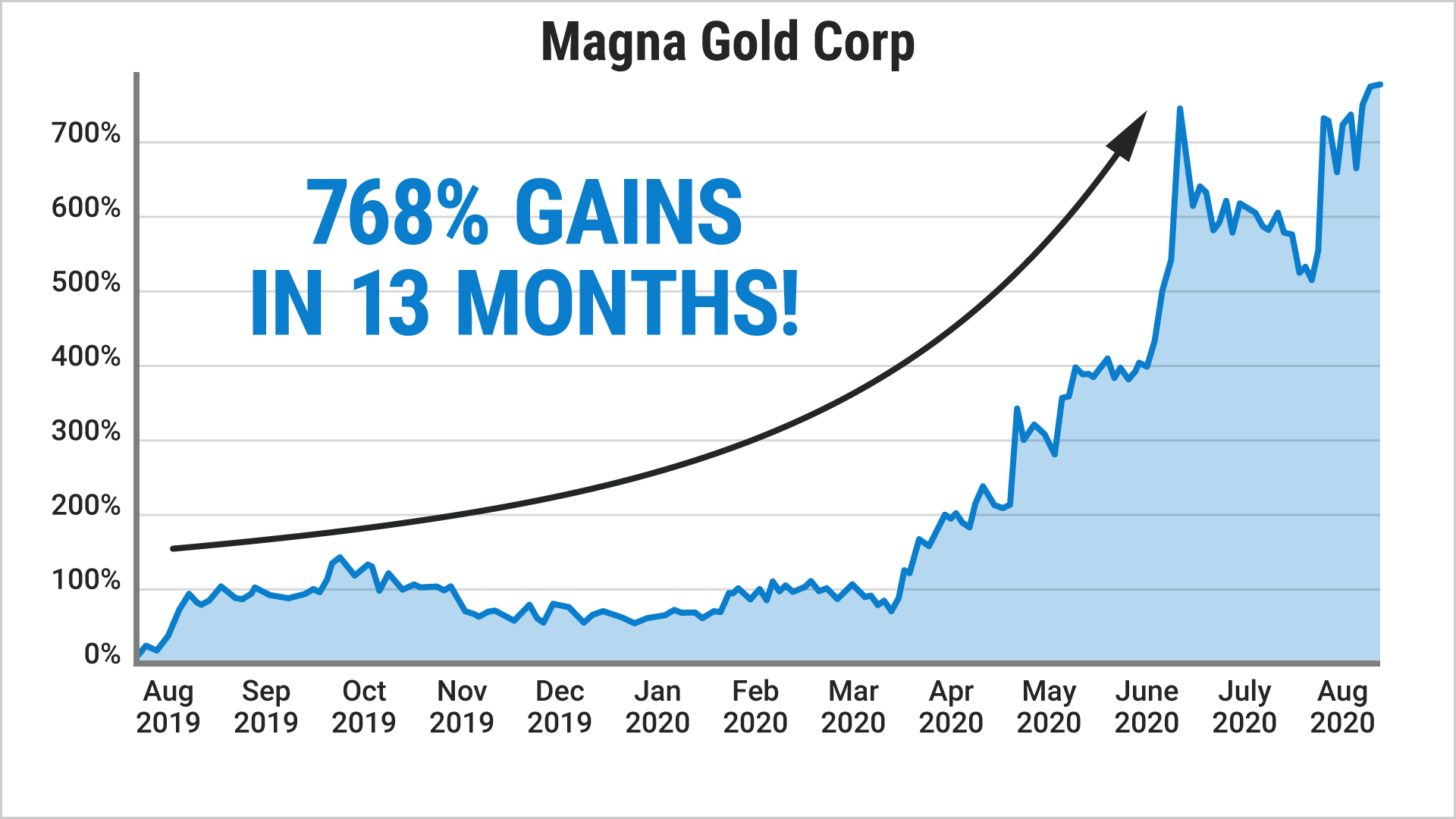

Gerardo did it again with a small gold and silver miner named Magna Gold.

This junior resource company delivered 768% gains in just thirteen months.

Again, these are actual returns.

Turning a $10,000 investment into $86,800.

And he didn’t keep this information to himself.

Gerardo also shared these industry finds with a small group of investors who were able to join him in making gains.

This group made serious money when Gerardo told them about a junior miner named Nevada Sunrise, which delivered 1,450% in just five months.

That’s almost 15x your money.

And you would have turned every $10,000 you invested into $155,000 if you were one of the investors following Gerardo’s lead.

And again, all these outstanding wins were discovered thanks to Gerardo’s industry contacts — it’s the ultimate advantage.

Now, I realize these big numbers seem extreme, but I have some news for you: these aren’t even Gerardo’s biggest returns.

He’s also made over 10,000% on a battery metals company — which personally made him and many others a 7-figure return.

And I should also point out that even though Gerardo has been making great money on junior resource companies for more than 15 years, and is a multi-millionaire from his success, many of these returns were made in the last 24 months.

We don’t need to cherry pick from his old hits... Gerardo has his finger on the pulse of today’s markets.

And it’s beating faster now than ever before.

When I asked him how he knew these companies would be successful, here was his response:

“John, the market for battery metals has grown more than 7x times since I bought into Patriot Battery Metals. And we haven’t seen anything yet… we’re facing down a $12-trillion-dollar supply gap. So this is just the beginning of what’s ahead.”

This is the chart he showed me, right here.

And this “blue water” technology is essential to what’s ahead.

Just like Gerardo’s other industry finds, it’s getting the insider attention that’ll make all the difference.

In fact, in just a few minutes I’m going to bring Gerardo on camera so he can tell us, in his own words, why it’s such a promising investment…

And why it’s not just industry momentum, he’ll explain why this blue water technology will change everything about the resource industry.

He’ll tell us…

- Why it’ll replenish the empty stockpiles for copper...

- Why it’ll fix multi-billion-dollar holes in the supply chain across America's industries...

- And why it could finally solve the problems faced by America’s major car companies as they shift to EVs, PLUS the crisis of America’s ailing power grid, AND the future the domestic computer chip industry.

Yes, it’s that big.

(And if that wasn’t enough, Gerardo also has a “surprise” announcement about this junior miner’s prospects. I’ll let him tell you about himself.)

There’s a reason all of this is happening right now.

We’ve never needed copper more than this moment.

While copper has been used by humans for millennia, it’s only in the last 12 months that we’ve seen such a dramatic paradigm shift of its role in the supply chain.

The Great Copper Deficit

Copper is facing a historic deficit… and as the decade wears on, it’s only going to get worse.

John LaForge, head of real asset strategy at Wells Fargo, had this to say:

“We'll look back… and think, ‘Oops,’ The market is just reflecting the immediate concerns. But if you really thought about the future, you can see the world is clearly changing. It's going to be electrified, and it's going to need a lot of copper.”

And copper is at the top of Elon Musk’s “emergency” list.

It’s because he can’t build any new Teslas without it.

Tesla uses more copper than any other battery metal in its cars.

They already consume 45,000 tons a year.

The Statue of Liberty’s exterior is made almost entirely of copper.

When you take the amount of copper used in the statue and compare it to this number, the result is the equivalent of 1,451 Statues of Liberty of copper — every year.

It’s one of the biggest line items in the Tesla budget.

And what a budget it is...

Tesla has now spent more than $100 billion to get the metals it so desperately needs.

Tesla currently makes 2 million vehicles a year — but they’re on track to boost production tenfold.

They keep opening new factories, including this one, which I recently visited in Austin, Texas.

Tesla’s plan is to produce 20 million vehicles a year by 2035.

And more cars means more copper.

According to the Copper Alliance, EVs use twice the copper of gas vehicles.

And as production lines scale up, there won’t be enough copper to go around.

America’s largest automaker, General Motors, is well aware of the problem.

Consider this quote from its Director of Purchasing:

“We’re absolutely convinced that this is a race, a zero-sum game and resources are a finite limit.”

— Tanya Skilton, Director of Purchasing, General Motors

They’re writing bigger and bigger checks to stay ahead.

Here’s how much America’s major auto manufacturers are spending on raw materials…

- Ford — $30 billion by 2030

- GM — $35 billion by 2025

- VW — $86 billion by 2026

- Tesla — $100 billion+ and counting

The only reason Tesla is at the top of this list is because its entire fleet is already 100% electric.

As more manufacturers go fully electric, these numbers will continue to grow.

It won’t be long before they’re all spending $100 billion each.

The World’s Largest Machine

Desperately Needs an Upgrade

The world’s largest machine isn’t in China or someplace overseas.

It’s right here, in every town and city in America.

It’s the US power grid, and it delivers more electricity than most people thought possible.

But here’s the thing…

The dreams of Dwight D. Eisenhower and Franklin D. Roosevelt, as lofty and impressive as they were, can no longer supply America’s future.

When I say that the infrastructure its aging, it’s because it was built entire generations earlier.

The majority of the wires crisscrossing the nation were built in the 1960s and 1970s.

And according to the US Dept of Energy, over 70% of transmission lines and transformers are at least 25 years old.

There’s no time to waste.

America needs more copper as quickly as we can pull it out of the ground.

The EV revolution is also having an enormous impact on the US power grid.

I’m talking about the 707,000 miles of high-voltage lines that stretch over every hill and valley, and out into every corner of the country...

Plus the millions of miles of low-voltage lines that connect every house and business.

It’s the largest grid in the world, and it's in desperate need of an upgrade.

I’m sure you remember reading in the news that California has banned the sale of new gas cars by 2035.

Soon it will be EVs or nothing.

But here’s the thing: if the State of California could press a button and magically turn every vehicle into in EV, there’d be no way to charge them.

The moment everybody plugged in their car, the power grid would go down instantly.

It’s clear that millions of Americans fully expect to plug in their EVs every night and get a full charge — with no thought to where that electricity is going to come from.

The grid is already at max capacity.

In fact, it’s even beyond max capacity in many areas of the country, which is why there are so many blackouts and brownouts — so a lot is going to have to change if it’s going to support millions of electric vehicles.

And when you consider that 15 more states are following California’s lead, this is a national problem.

And Uncle Sam is doing everything it can to speed things up.

The US Dept of Energy has just launched the “Better Grid” initiative, which is throwing billions of dollars into preparing America’s infrastructure so it’s ready to charge all these millions of electric vehicles.

And these grid upgrades can only be built with one primary material: copper.

And let’s not overlook the fact that copper is the backbone of just about every industrial activity out there.

Copper water pipes are still required in all commercial buildings.

From your local Starbucks to New York’s skyscrapers, add it all up and there are thousands upon thousands of miles of new pipe needed.

But from where?

There is no Copper Santa...

Only existing pit mines, which are already pushed to capacity.

Nick Snowdon, Goldman Sachs Head of Metals, put it this way to Bloomberg:

“The thing about the copper market is that we've never been in such an extreme set of fundamental circumstances. We've never had to go to end demand destruction pricing to achieve a rebalancing. The bull market of the 2000’s was nearly entirely solved by supply responses. And a very rapid increase in mine investment. That's clearly not going to be the majority solver this time… So we don't rule out that copper could be a [$25 or even $50 a pound.]

That’s right, the head of metals for Goldman Sachs is saying that copper could soon be worth 5x… even 10x… more than it is today.

And as investors, those rising prices are going to put dollars in our pockets.

When you consider that the blue water project I’m visiting is set to produce at least 1.27 billion pounds of copper over its operational life, that’s a lot of dollars coming through the door.

At current prices, that's already $5.8 billion.

But if prices climb as high as Goldman Sachs predicts they could, that translates to at least ten times that... to $58 billion.

What’s already a great investment becomes an outrageous, millionaire-making investment.

And there’s a reason why...

Old Mining is Too Slow — And Too Risky and Expensive to Meet Future Demand

Traditional mining is massively expensive and horrifically slow.

Rio Tinto knows this better than anyone else.

Their new copper mine in Mongolia, which is now one of the largest, after years of delays, cost blow-outs and billion-dollar disputes with the country’s government.

As the CEO said: “It has not been a smooth ride.”

They’ve already sunk $7 billion into the project — and have yet to produce a single ounce of copper.

Rio Tinto is blunt about the fact that the Mongolia experience is part of why they’ve been so motivated to increase their investment in blue water technology.

They need a safe source of copper.

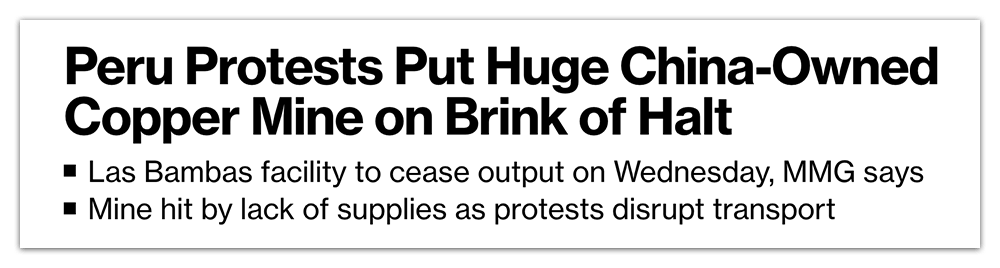

Because in Peru, Chile, and other South American districts, there have been protests, delays, and showdowns with government cronies...

Everything you don’t want to see as an investor.

Each delay costs copper producers millions of dollars.

And of course, further squeezes a supply chain that’s already over extended.

And worst of all?

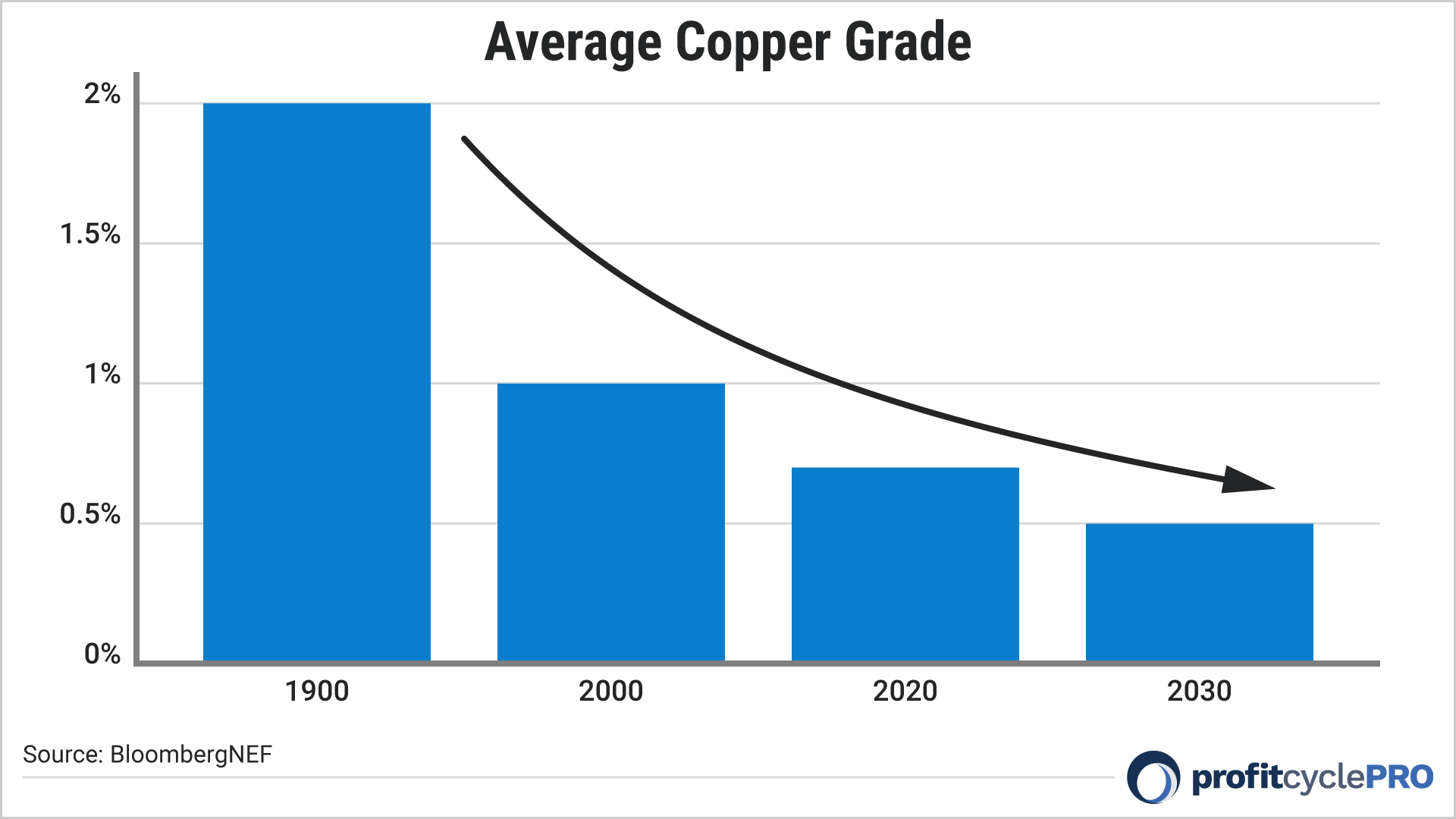

Traditional Mining is Suffering from Perpetually Declining Copper Grades

You see, all of the low-hanging fruit has been picked.

After 10,000 years of mining, all the easy-to-access high-grade copper has been dug up.

As one industry insider put it to S&P Global:

“In the copper industry, you've got declining grades. So, there's less copper per ton of ore that's getting mined at operations these days. That's not going to get better. Grades are going to continue to decline. Mining companies aren't finding super deposits like they used to in the 20th century and even at the beginning of this one.”

And even advanced exploration technologies aren’t enough to improve this fate:

“There are other companies focused on exploration, but exploration isn't going to solve the copper needs that the industry has right now or in the next decade. Even if you found a new Escondida in the next year or two, you're not going to have that copper production until the late 2030s.”

An estimated 80% of the world’s remaining copper is low grade.

And worse still, it’s stuck in this chunky waste rock that’s considered impossible to mine.

So even though this is the most abundant form of copper on the planet, it’s largely useless.

That is, until now.

Recovering the World’s Largest Stranded Resource

What I’m holding right here is called “chalcopyrite.”

(To say that word correctly, just replace the C’s with K’s.)

The copper is surrounded by this chalky, dusty, crumbly type of rock that disintegrates in your hand and is depressingly bland.

As I said, it’s the trash of the mining industry.

It’s so unloved that it’s put into piles that become the size of mountains and left to bake in the sun, never to be thought of again.

The grade of copper isn’t high enough to justify sending it to be crushed up and put in a smelter.

And it’s long been thought that copper leaching wasn’t any better.

While commercial-grade heap leaching operations have been around since the 1950s, no solutions existed for getting copper out of chalcopyrite.

New technology — and new chemicals — have made it possible to pull the copper out of this rock.

This changes everything from a mining perspective.

As one industry expert put it: this is the “Holy Grail” of discoveries.

Finally Reaching The “Holy Grail” of Copper

It’s taken decades to get to this point.

But now blue water copper leaching has become such a game changer because it can extract copper from a variety of copper grades, including from rock that’s too low grade to justify sending to the refinery.

If this sounds high stakes, it’s because it is.

Here’s why blue water is such a game changer.

What was once useless chalcopyrite is now feasible mining material.

A Magical Solution That Turns Trash into Treasure

But it gets even better than this.

This junior miner doesn’t have to go dig any new chalcopyrite out of the ground in order to turn a profit.

Why?

Because mining companies have been pulling chalcopyrite out of the ground for over a century and putting it into useless piles.

And this junior miner has carefully planned their debut of this next-generation copper leaching...

By securing access to a unique stockpile in Arizona.

Take a look at where I’m standing right now.

I’m standing on 223 million pounds of mining tailings.

And this is the hole in the ground they came out of.

The company that mined it shuttered its operations decades ago — when copper mining moved overseas to cheaper mines.

Those were dark days for American mining...

When we imported everything.

But now is the renaissance.

There are millions upon millions of dollars of copper in this pile.

And that’s at current prices... it could easily be worth 2x, 3x, or even 4x that just a short time from now.

All this leftover rock, neatly piled in square-mile sheets, can now be “mined” by using this solution.

It’ll be carted over to this blue water firm’s next-generation leaching pad.

And drip-by-drip, out comes the copper that America so desperately needs.

72% of the copper inside the rock can be recovered from this leaching process.

There’s no need for a smelter, and no need for costly or expensive refinements.

The blue water solution can be turned directly into sheets of copper using an electrical process that takes no time at all.

As it stands today, almost 50% of mining waste comes from copper.

There are 4.3 gigatons produced every year.

This new copper leaching technology challenges the entire calculus.

From 1% to 99.99%

I don’t want to get lost in the details, but I think it’s important that I show you how drips of blue water can be turned into sheets of near-pure copper — all in a matter of hours.

Here’s how a vat of foamy blue water gets turned into plates of pure copper after it goes through the rock:

- First, the blue water (which is officially known as “pregnant solution”) is put into a tank with two electrodes: one anode (positive) and the other cathode (negative). The electrodes are usually made of stainless steel.

- When an electric current is applied to the electrodes, the copper ions in the solution are attracted to the cathode and stick to it, forming a layer of pure copper.

- The longer the electric current is applied, the thicker the layer of copper on the cathode will become.

- Once the sheet reaches its max thickness, it’ll be pulled up out of the solution. Voila! A hardened sheet of shiny copper.

What Fracking Did for Oil…

Blue Water Will Do for Copper

(And Without Any of the Nasty Side Effects!)

It wasn’t long ago that America was dependent on the rest of the world for oil.

OPEC pushed the US government around and demanded high prices.

Petro politics led to wars, conflicts, shortages, and embargos.

And across the globe, industry analysts warned of the potential of “Peak Oil.”

But fracking changed all of that.

In a few short years America went from a needy energy importer at any cost…

To complete energy independence.

Smart investors lined their pockets with massive gains.

Blue Water has the potential to do the same for copper mining.

But unlike fracking, which is a bad word in many circles, due to its negative impact on the landscape and potential to spoil the environment and ruin lakes and rivers…

Copper leaching doesn’t have any of those problems.

In fact, it’s the lowest-impact way to mine copper, period.

The switch to blue water would be an outstanding win for the environment.

The Return of “Made-in-America” Copper

In the US, there’s also been a push (and billions of dollars in subsidies) to move mining back to America, where the supply chain is better protected from the disruption of wars, pandemics, and international politics.

Raw materials like copper have quite simply become too essential to leave exposed to those outside forces.

Bill Gates and Jeff Bezos have pulled money from other investments and are putting money into copper — literally just weeks ago.

And billionaire Ray Dalio is buying up massive stakes, as is his former hedge fund Bridgewater Associates.

The Last Copper Spike

The last time we saw a copper spike of this scale was in 2013.

I’m sure you remember some of the headlines.

- Copper was so valuable that it was being stripped out of abandoned buildings.

- Wire was locked up on construction sites, with 24/7 security.

- People were taking apart old electronics to pull out any parts that contained copper.

Well, as I’m sure you’ve likely noticed, the price of copper has returned to these same record-breaking levels.

Now, I’ve kept you waiting long enough.

Let’s talk with our in-house resource expert Gerardo Del Real, so you can hear for yourself why blue water is the future of copper mining…

And why this small junior resource company is in such a unique position to profit on its development.

This Is the Moment Where We Profit as Investors

JOHN:

Gerardo, thanks so much for joining us.

So we’re here at a copper mine in Arizona, about an hour south of Phoenix, in an area that’s come to be known as the “Bread Basket” of American copper.

But most importantly for everything we’ve talked about today, we’re here on a property that’s owned and operated by a junior resource company with major potential.

At what will soon be ground zero for next-generation blue water copper leaching.

GERARDO:

Thanks so much, John, happy to be here.

It’s been an action-packed visit.

And I’m excited about all that we’ve seen here today.

It’s hard to convey the sheer sense of scale — because this place is massive.

Right behind us is a historical pit mine from the previous operators of this site.

This place was shuttered in the 1970s, and they left behind millions and millions of pounds of waste rock… the mining tailings that at the time were thought to be “useless.”

Every pound contains a little bit of copper…

And now, with this junior miner’s new leaching technology, now they can finally pull that copper out of the rock.

As you’ve told everyone John, this old mine’s trash is now a mountain of treasure.

We walked over to the site of the leaching pad, which is under construction, and the moment it’s fully operational — they’re going to turn this pile into a cash cow.

Today’s Blue Water Will Create

Tomorrow’s Green Winners

These new blue water copper leaching solutions are going to create tomorrow’s green winners.

And I mean “green” in every sense of the word.

It’s going to be an outstanding win for the environment.

This is the stuff of dreams… where waste rock can give the world the copper it needs.

Copper leaching could even one day eliminate the need for most pit mines.

It can build all the electric vehicles… the solar panels… the green revolution.

And then of course it’s going to deliver for investors, too.

Just as we saw during this last copper boom.

And then this new copper leaching technology is also going to drive profits, just as we’ve seen before.

I’ve made money on lithium brine… on in-situ uranium leaching… and now we’re seeing these same types of innovations make their way to copper.

JOHN:

Absolutely. And I should say here, for everyone watching, Gerardo isn’t some armchair analyst.

He’s traveled all over the globe to find discoveries exactly like this.

Visiting mine sites...

Inspecting their operations...

Talking with their management team, their geologists, their drillers.

That’s the only way to find insider-level opportunities.

And I have the perfect example of why: just two years ago Gerardo bought in early to an EV battery metals company.

The only reason he knew about it is because of his network of mining contacts.

I can’t reveal the name of that mining company here, because Gerardo is still holding shares, but the value of Gerardo’s stake has now climbed above 7 digits.

This is REAL money we’re talking about.

Millions of dollars, on one single trade.

JOHN:

Gerardo, when you first got started in investing, did you ever imagine you’d be making trades like this?

GERARDO:

I didn’t, John.

I always take each success as it comes…

And to learn from each and every one.

And I’m not a fortune teller: there have been plenty of setbacks along the way.

But I learned from those, too.

That’s been the recipe for lasting success.

And not just my success…

I share all of my research with my readers, who’ve been able to join me on this wealth-building journey.

And that’s the real point: my readers have been able to make tens of thousands...

Hundreds of thousands...

Even a million dollars on a single trade.

Just as I have.

That’s been a gratifying part of it, to see what a positive impact it makes, and share it with others.

I love this stuff.

We’re out here in the desert because this is how it’s done.

This is how you get the full story on what matters, and how you find the new technologies that make a difference.

This is how the real money is made.

JOHN:

Well said.

Because you certainly have a dedicated following of devoted fans.

I even took the time this morning to print out a few, because I think it’s important to highlight the impact your research has made for so many investors.

Here’s what an investor named George F wrote to us and said:

Thank you Mr. Del Real… thank you! Since using your publication my portfolio has risen… to a rapidly advancing $110,000. This is truly a dream unfolding! Thank you for your publications based on hard work and something that today is hard to find… your HONESTY and INTEGRITY!

—George F.

And then another one of your fans, Jack S., wrote to us:

Gerardo is just fantastic, there’s no other way to say it. I make money. No... he makes money for me. Big time! He’s been giving me a Christmas present every month... and all I can say is we are not talking about nickels and dimes... this guy is really, really great.

—Jack S.

And there’s one last testimonial I’d like to tell you about.

And that one’s from me.

Gerardo, you told me about a junior resource company called Leading Edge Materials.

I’m sure you remember it.

GERARDO:

Why yes I do.

JOHN:

Thanks to your recommendation, I bought into Leading Edge Materials right before they announced positive permitting results.

The stock soared and I doubled my money in just two months.

I made $4,000 on that one trade.

And I know there were other investors who made even more.

GERARDO:

That’s why I follow these companies so closely.

Because it’s the only way to find out what’ll make a difference for investors.

And you make a good point John.

There’s also a choose-your-own-adventure aspect to all of this.

I have investors who’ve made thousands, which is great. Because that’s where they wanted to start.

And others put in more, and make tens of thousands… hundreds of thousands.

I’m here to help investors of all stripes work toward their goals.

If you want to make millions, I’m here for that, too.

JOHN:

Sounds good to me!

So, I’d love to hear a bit about your industry contacts.

I know that’s one of the most important factors in your success, and it’s something I wanted to emphasize.

GERARDO:

Yes, mining is a tricky one.

Some industries are about WHAT you know.

Others are about WHO you know.

But mining is BOTH.

It’s both a “what-you-know” and “who-you-know” business.

I’ve been fortunate to cultivate a long list of contacts within the industry, and they’ve been essential to making money year after year.

JOHN:

A few years ago I was able to join you at a conference, and I saw that first-hand.

I flew to Beaver Creek, Colorado, to the incredible ski resort there, and attended an invitation-only gold exploration conference.

And when I say invitation-only, I mean it.

Truly exclusive.

Three different times I had a security guard check my conference badge to verify I belonged there.

I was only included because I was riding on Gerardo’s coattails.

I got to meet industry heads who I’d read about for years... and there they were in person.

We’re talking the true movers and shakers of the business.

Many of them important billionaires.

But here was what impressed me the most: Gerardo, they knew you by first name.

Billionaires were coming up to you and saying, “Hi Gerardo, so good to see you again this year!”

GERARDO:

Yes, it’s been a perk of the job.

But what matters most to me is not that people know who I am, as flattering as that is.

What matters to me is what I learn from this network of insiders — and the opportunities I’m able to discover by putting the time and work into listening, into asking the right questions...

I arrive having done my homework, so that when a discussion about a new mining site, or a new permit, or a new financing deal comes up, I’m already in-the-know on what to talk about.

JOHN:

And if you’d let me brag a little more on your behalf, all of these industry experts were excited to be talking to YOU.

You weren’t chasing after these guys, they were coming to you.

And eager to tell you about their discoveries.

Gerardo conducted more than a dozen in-depth interviews at that exclusive mining conference, as he does every year.

GERARDO:

Keeping up with these industry insiders is just as important as visiting mining sites in the desert.

It’s how we keep our edge on what matters.

JOHN:

And that brings us back to this junior miner. Because as you said, Gerardo, we’ve seen a lot during our visit here.

GERARDO:

Absolutely.

This junior miner is testing new leaching solvents even as we speak.

Tubes filled with test soil from around the world are fed test solutions drip-by-drip, 24/7.

And we just toured the massive warehouse where the testing samples are stored.

Every minute that passes, more test solvents drip through the tubes you see here and into samples of test rock.

The recipe for each solvent is being tweaked for maximum leaching strength.

And once it’s ready, they’ll work with Rio Tinto and Nuton.

JOHN:

I’ve never heard of such a small company with important partners like this.

GERARDO:

That’s because it never happens.

As you said earlier John, it’s not often we find a junior with such major potential.

Rio Tinto… McEwen Mining… Ivanhoe Electric…

These are the biggest and most powerful names in the business.

This level of industry support is unheard of.

Those are some important friends to have.

Rio Tinto has put millions of dollars into this company — they’re not going to let it fail.

They’re just as excited as we are about what this junior miner can do.

JOHN:

And that’s the perfect segue, Gerardo, for the “surprise announcement” you promised us.

GERARDO:

Yes, it’s the best kind.

So John, as we’ve said, this junior miner has millions and millions of pounds of copper tailings…

And they’ll be able to turn those into cash the moment their leaching pad is fully operational.

Without a doubt that’s exciting stuff, and already makes this company a worthwhile buy.

You could make a fortune on that potential alone.

But John, here’s what’s most exciting to me — and it’s something that few outside of the mining community know about.

It’s also the reason that we flew all the way out to Arizona to investigate this for ourselves.

So this is the surprise announcement:

This junior miner is finding NEW deposits of copper in the ground beneath our feet that will continue to expand the size of this opportunity.

John, you and I met earlier with this company’s Vice President of Exploration.

And I couldn’t be more excited about the drilling program he’s mapped out.

Pretty much every square inch around us has the potential to expand this opportunity.

You can see the drills behind me.

They’re turning 24 hours a day, 7 days a week.

I’ve looked over the exploration map, and they’re exploring every part of what looks to be a massive copper porphyry system.

It’s so big in fact, that it extends even beyond the edge of the property border.

And this part is also news: mining giant Ivanhoe Electric has just secured a property right across the street.

And that’s one more testament to the “major” potential of this junior.

When all the majors are elbowing their way in for a piece of the action, that’s when you know you’re on to something.

But get this, John.

From core samples and the assay results we’ve seen, the best stuff is right here.

I inspected these core samples myself, and they look great.

I like the grades they’re getting.

As you told everyone earlier, John, when it comes to copper exploration, most of the low-hanging fruit has already been picked.

The average grades of new discoveries are declining around the world...

They’re finding less and less with each passing year, even with all the technology they’re using.

So this really means something when I tell you that this copper is getting such good grades.

We’re seeing 1%, up to 2%. And even 3% high-grade copper in many places.

And even where the average grade is 1%, because this junior resource company is focused on their blue water technology, they’re actually able to boost those numbers a bit...

That’s because the amount of total soluble copper is always higher than the old-school base measurement.

So they’re able to squeeze more copper out of those rocks than anyone else.

So all told, this is an opportunity that’s going to grow... and grow... as more and more quality grade copper is found on-site.

John, this is how fortunes are made.

A Junior with Major Potential

JOHN:

I couldn’t agree more.

Which brings us to our special report on this company, which is the entire reason we’re here.

I’ve worked directly with Gerardo to put together everything you need to know about how to profit from this unique opportunity.

We’ll explain in detail how this junior miner’s business model is built to scale up and up as demand pushes the price of copper higher.

GERARDO:

That’s right. I can’t say it enough: they’re a junior with major potential.

I’ve researched every aspect of this opportunity, and I like what I see.

They have a solid leadership team with the experience to get the job done.

It’s run by industry experts who’ve seen copper shortages before…

They’re quite aware of what’s at stake, and they’ve carefully built their business plan to make the most of the coming demand.

The state of Arizona loves them, regulators love them, and this site is a mining-friendly community that welcomes the jobs and opportunities.

There’s nothing holding back this mining company from major success — it’s all in the report.

JOHN:

This report is yours free, and I’d like to rush you a copy right away.

I’ll ask in return is that you try my research service Profit Cycle Pro...

Because finding profitable investment opportunities like this are what it’s all about.

The goal of Profit Cycle Pro is to give you an inside look at the lucrative research that experts like Gerardo Del Real are unearthing every day.

When you click the button below, you’ll be taken to a short order form that shows you how to get started...

Including an introductory low price that’s just for you.

It’s simple, straightforward, and takes just a minute.

GERARDO:

That’s right. We’re here to show you great research that’ll deliver profitable results.

We’re not here to waste your time.

It’s all in the report.

John’s service is outstanding, you should give it a try.

It’s guaranteed, so you’re risking nothing.

And I'm a resource expert, not a salesman.

So that’s that.

If you want the real deal then this is it: this is what we do.

We’ve got a lot in store.

JOHN:

I mean, well said!

It truly doesn’t get any more straightforward than that…

Copper is one of the most important raw materials on the planet.

And our modern future is only going to be possible with this copper leaching technology.

This report will show you everything you need to know to join us in making a fortune on this junior mining company.

All the details are inside, and we look forward to showing you what’s possible.